Activities for the 4th of July

Never miss a thing in your community

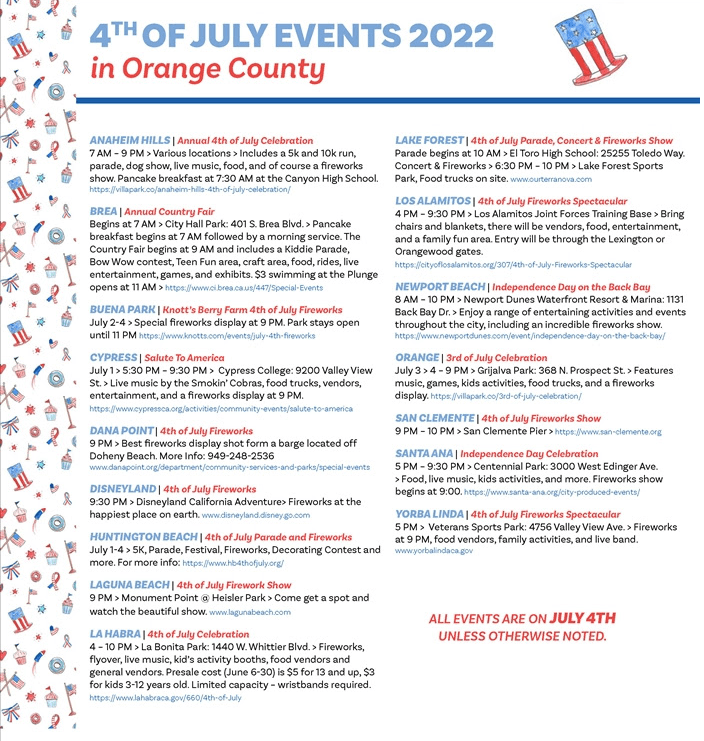

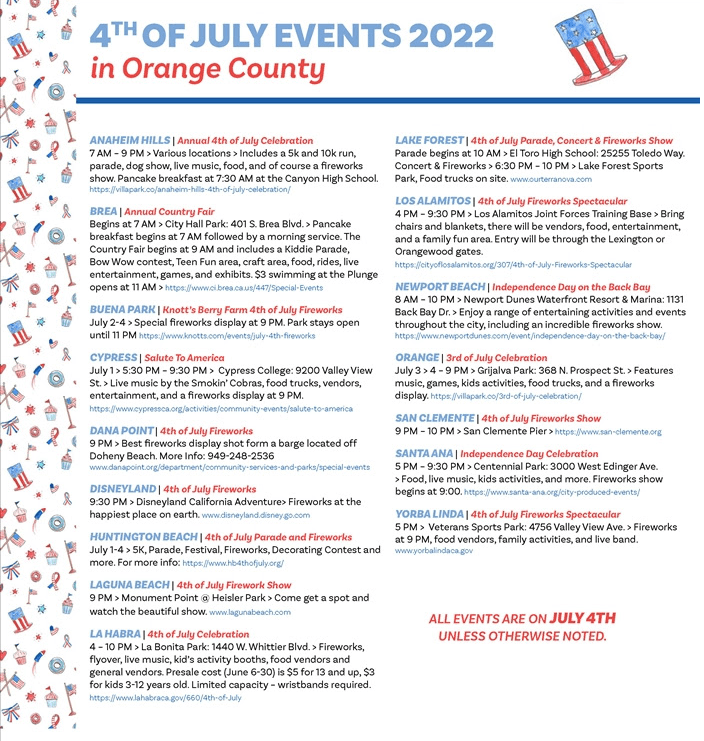

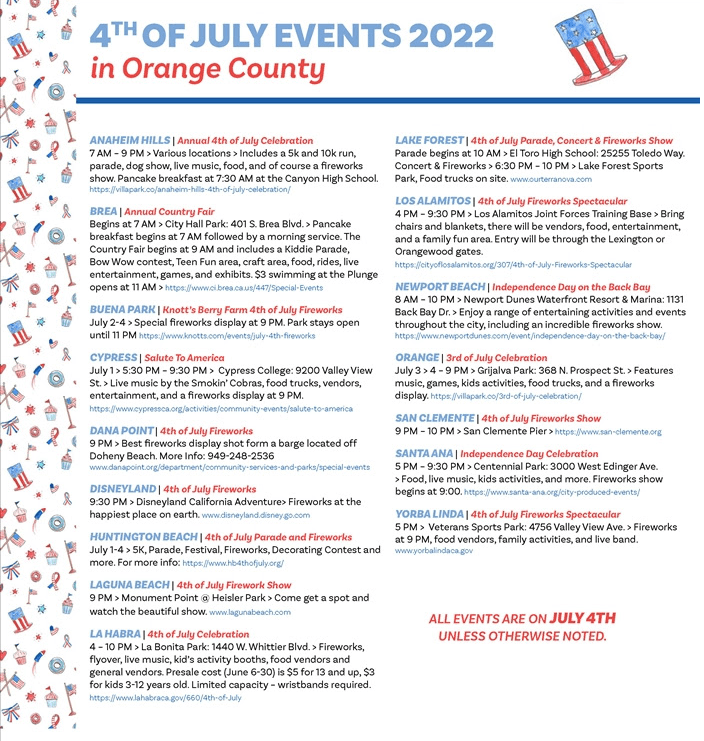

The Fourth of July is one of the most popular holidays in the United States and is ubiquitous with BBQ gatherings, parades, and of course, fireworks. As you prepare for this year’s Fourth of July celebrations, here are some safety tips for the Fourth of July to help keep you and your loved ones safe:

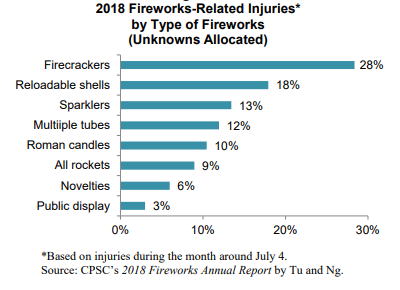

Most folks, most of the time, have not and will not experience these (admittedly) scary statistics. Fourth of July should be a fun time spent with family and friends in celebration of our nation’s birth, rather than feeling worried or stressed about possible accidents. However, knowledge is power, so keeping the following in mind can help you better plan your activities in a way that prevents mishaps.

An estimated 19,500 fires started by fireworks were reported to local fire departments in the US during 2018. These fires caused five civilian deaths, 46 civilian injuries, and $105 million in direct property damage.

(See NFPA Research for all statistics.)

(Check out these tips for getting your home Fourth-of-July ready)

And now that you’ve brushed up on staying safe, don’t forget to have a fun-filled Fourth of July weekend!

You may have heard that pre-approval is a great first step in the homebuying process. But why is it so important? When looking for a home, the temptation to fall in love with a house that’s outside your budget is very real. So, before you start shopping around, it’s helpful to know your price range, what you’re comfortable within a monthly mortgage payment, and ultimately how much money you can borrow for your loan. Pre-approval from a lender is the only way to do this.

According to a recent survey from realtor.com, many buyers are making the mistake of skipping the pre-approval step in the homebuying process:

“Of over 2,000 active home shoppers who plan to purchase a home in the next 12 months, only 52% obtained a pre-approval letter before beginning their home search, which means nearly half of home buyers are missing this crucial piece of paperwork.”

This paperwork (the pre-approval letter) shows sellers you’re a qualified buyer, something that can really help you stand out from the crowd in the current ultra-competitive market.

How competitive is today’s market? Extremely – especially among buyers.

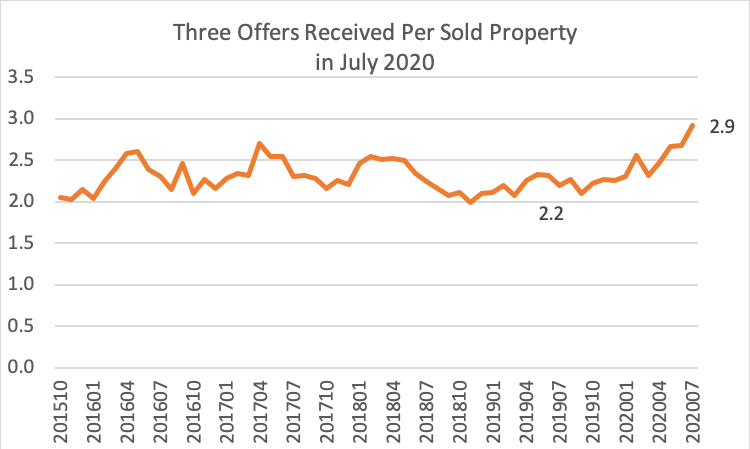

With limited inventory, there are many more buyers than sellers right now, and that’s fueling the competition. According to the National Association of Realtors (NAR), homes are receiving an average of 2.9 offers for sellers to negotiate, so bidding wars are heating up.

Pre-approval shows homeowners you’re a serious buyer. It helps you stand out from the crowd if you get into a multiple-offer scenario, and these days, it’s likely. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war and land the home of your dreams.

Danielle Hale, Chief Economist for realtor.com notes:

“For ‘a buyer in a competitive market, it’s typically essential to have pre-approval done in order to submit an offer, so getting it done before you even look at homes is a smart move that will enable a buyer to move fast to put an offer in on the right home.’”

In addition, today’s housing market is also changing from moment to moment. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals (a loan officer and a real estate agent) making sure you take the right steps along the way and can show your qualifications as a buyer at the time you find a home to purchase.

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. If you’re ready to buy this year, reach out to a local real estate professional (who can also connect you with a trusted lender) before you start searching for a home.

August 24, 2020By: Scholastica (Gay) Cororaton

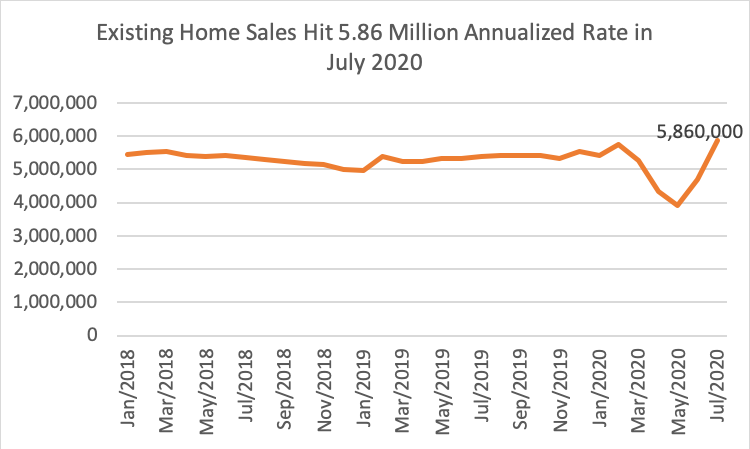

Several indicators point to the quick recovery of the housing market from the pandemic slump during April and May, with home sales on an annualized rate in July now above the February level. Indicators gathered from a survey of REALTORS® that are reported in the August REALTORS® Confidence Index Survey also show that homebuying demand is strong, which means that the rebound in sales as a result from the end of shelter in place measures is likely to be sustained in the coming months.

Existing-home sales rose a record 24.7% in July to an annualized rate of 5.86 million, which is higher than the pre-pandemic February level (5.76 million). On a year-to-date basis, existing-home sales (2.917 million) are just 5% below last year’s seven-month period level (3.062 million). The median existing-home sales price rose 8.5%, to $304,100, as demand strongly absorbed the supply coming into the market. As of the end of July, the level of inventory of homes for sale on the market was only equivalent to 3.1 months at 1.5 million homes, down 21.1% from one year ago.

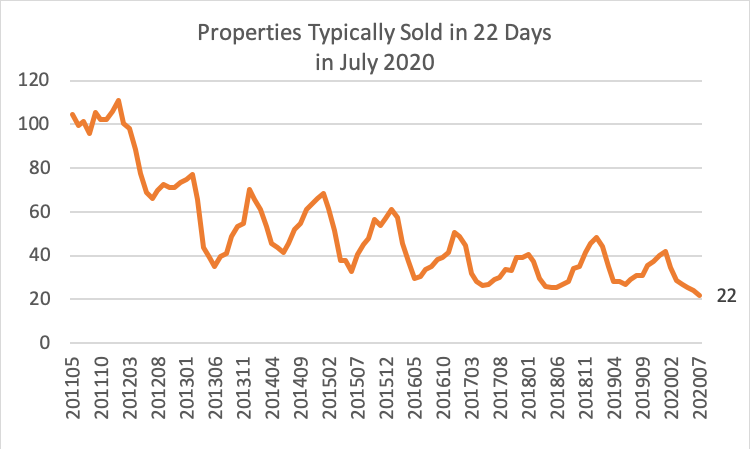

Properties were typically on the market for 22 days, a record low since NAR collected this survey-based information in 2011, according to the August REALTORS® Confidence Index Survey, a monthly survey of REALTORS® on their transactions during the month. One year ago, properties typically sold in 29 days. This is also faster than the median of 36 days in February prior to the coronavirus outbreak. Sixty-three percent of properties sold within one a month, compared to 51% one year ago and 47% in February.

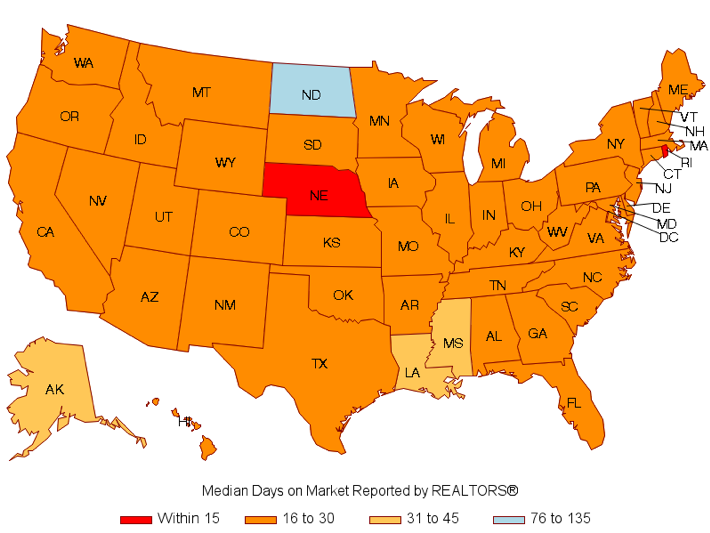

In almost all states, except for North Dakota, Alaska, Louisiana, and Mississippi, properties typically sold within one month. In Nebraska and Rhode Island, REALTORS® reported that properties typically sold in 15 days. Properties also sold quickly in states such as Idaho (17 days), Utah (18 days), Indiana (18 days), Tennessee (19 days), Washington (19 days), Massachusetts (19 days), Arizona (20 days), Colorado (20 days).

Not only are properties selling quickly, but they are also getting more offers. On average, REALTORS® reported nearly three offers per sold property in July 2020, up from about two offers one year ago.

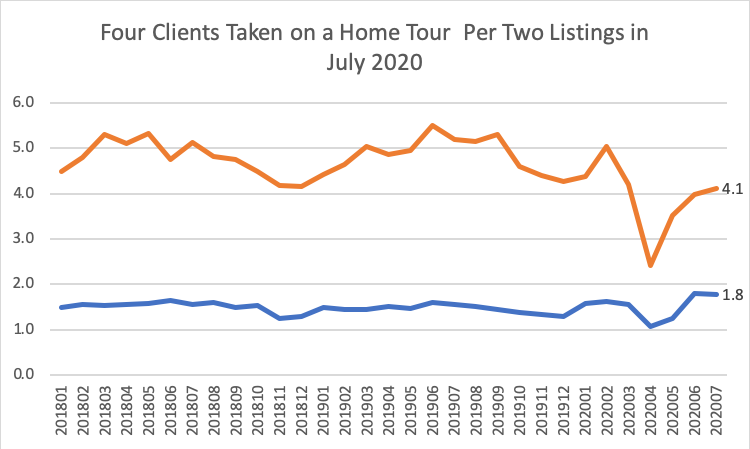

Demand has outpaced supply. On average, REALTORS® reported taking out four clients on a home tour, up from an average of two clients in February. Meanwhile, on average, REALTORS® reported listing only nearly two properties in July, although this is up from about one listing in April.

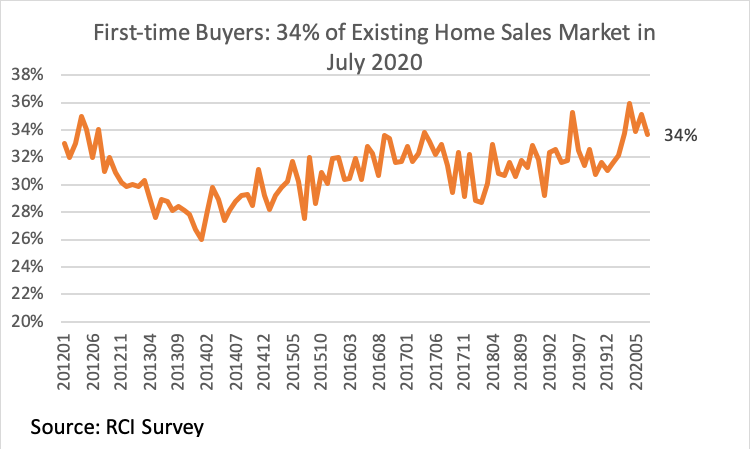

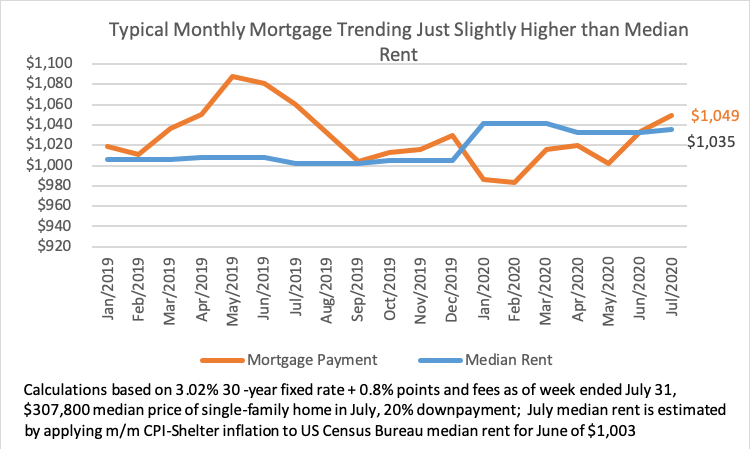

Who’s buying? In part, first-time homebuyers, which made up 34% of homebuyers in July 2020, up from 32% one year ago. Mortgage rates are at ultra-low levels, with the 30-year fixed rate averaging 3.02% in July 2020. The strong price appreciation has increased the monthly mortgage payment to $1,049 on a home purchased at the median sales price of $307,800 and financed with a 20% down payment loans, but this is just a little higher than the median rent of $1, 035. Concerns about safety and social distancing may also be increasing the demand for homes.

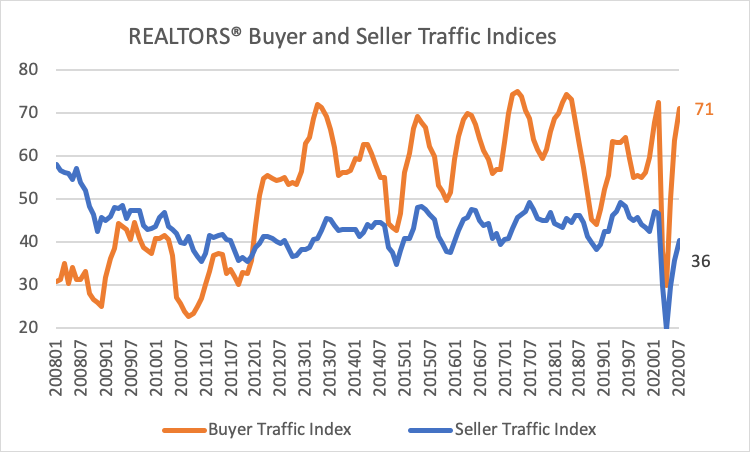

Compared to one year ago, about 4,000 REALTORS® reported that buyer traffic was broadly “strong.” The REALTORS® Buyer Traffic Index hit 71 in July, about the same level in February (72), after the index fell to below 50 in March and April.1 The housing market recovery has been relatively swift compared to the pace of recovery during the Great Recession when the Buyer Traffic Index stayed at below 50 from 2008 through 2011. Meanwhile, supply is broadly “weaker” compared to one year ago, with the REALTORS® Seller Traffic Index trending below 50.

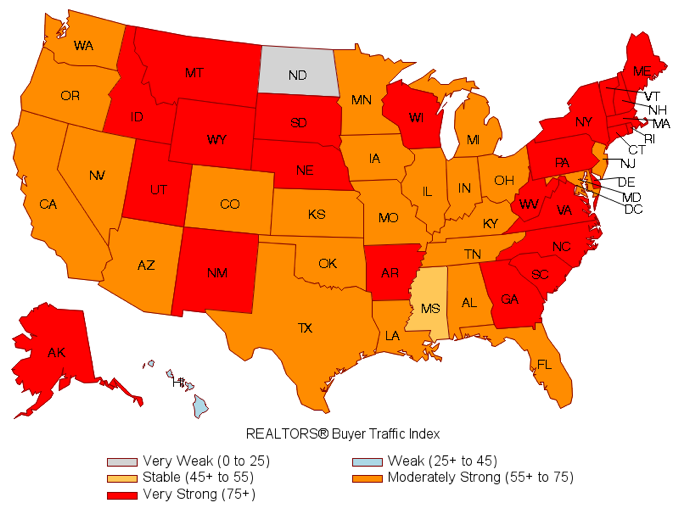

Respondents from all states reported that market conditions were broadly stable or strong, except in North Dakota which continues to be impacted by the drop in crude oil prices.

1 The index measures homebuying activity in the reference month (July) compared to one year ago. An index above 50 more respondents reported that home searching activity rose compared to one year ago than the number of respondents who reported a decline.

by First Team Real Estate | Aug 7, 2020 | Real Estate News, Selling | 0 comments

It’s hard to believe that the real estate market could be booming in the middle of a pandemic. But the fact is, coronavirus hasn’t killed the housing market, it’s helped reveal how viable and healthy it really is. With buyers and sellers continuing to safely and securely close home transactions amid COVID-19, the real estate market is a great bet right now.

Need to see the proof? Let’s review the facts and figures of buyer and seller activity that reveal the housing shortage and bidding wars contributing to a housing boom on pace to continue for several years.

In July, new home sales surged 55%, experiencing their biggest gain since 2005. In addition, mortgage applications to purchase a home rose 33%, and mortgage refinances jumped 111% compared to last year. Interest rates hit historic lows, dipping below 3% for the first time in 50 years, and encouraged a record number of buyers to purchase homes as Americans are recognizing the true value of a home. Coronavirus has reminded us all how precious our homes are, and for buyers, that means they’re willing to prioritize housing even as they cut back on other expenses.

Last month, the average home sale price spiked 6%, continuing over 8 years of gains, according to the National Association of Realtors (NAR). That’s why right now is the ideal time to sell for most homeowners who have equity because they can cash out for top dollar and then secure their next home for less with a low mortgage rate. Coronavirus has not negatively affected home prices like some expected, in fact, it’s helping them grow. It’s just simple supply and demand.

Today, the supply of homes for sale is tight. And with record numbers of house hunters entering the market, they are pushing up home prices. There are two main factors that contributed to our housing shortage, beginning back in 2008. First of all, home builders have been cautious since the Great Recession, building fewer homes every year since the market crash. Since 1959, on average, 1.5 million homes were built each year according to Census Bureau data. However, in the past decade, only 900,000 homes have been built each year!

Second, millions of homeowners understandably chose not to list their homes during quarantine which has shrunk inventory even lower. The real estate market was hit the hardest in March and April and has begun its rebound, but the market has a long way to go.

Millennials homebuyers who are officially ready to enter the market are putting pressure on the limited inventory as well. According to the latest NAR Profile of Buyers and Sellers, millennials by far make up the largest segment of homebuyers, 38% of all buyers. This only makes sense because the average millennial turns 32 this year, coinciding with the median age of a first time home buyer, which is 31. So as millennials continue to hit home-buying age amid our housing shortage, we will continue to experience a fiercely competitive real estate market.

Over the past three months, there has been an uptick in bidding wars on the real estate market. Following new regulations for safe home viewings, buyers are continuing their house-hunting despite the pandemic. For example, First Team agents Geoffrey and Lisa Thompson who listed their home for sale during the COVID-19 lockdown received an overwhelming buyer response with multiple offers.

Affordable homes for sale in Southern California nearly always sell quickly, and the high-end luxury market is now following suit, like this Yorba Linda vineyard that sold for $8.75 million in just 4 months with multiple offers. And this $7.25 million beachfront home in Laguna Beach that fell out of escrow in March, but ultimately sold in June with 3 competing offers.

The conditions of low supply and high demand won’t be solved overnight, which all but guarantees the housing boom we’re currently experiencing has years left to play out. So if you’re ready to sell your home and move onto the next stage in your life, this is the perfect time to do it.

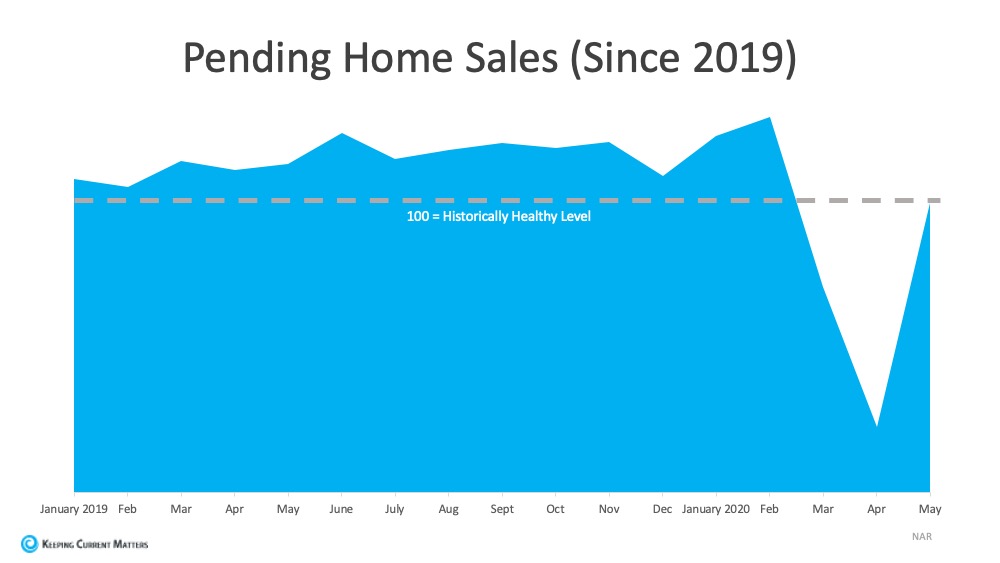

Pending Home Sales increased by 44.3% in May, registering the highest month-over-month gain in the index since the National Association of Realtors (NAR) started tracking this metric in January 2001. So, what exactly are pending home sales, and why is this rebound so important?

According to NAR, the Pending Home Sales Index (PHS) is:

“A leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.”

In real estate, pending home sales is a key indicator in determining the strength of the housing market. As mentioned before, it measures how many existing homes went into contract in a specific month. When a buyer goes through the steps to purchase a home, the final one is the closing. On average, that happens about two months after the contract is signed, depending on how fast or slow the process takes in each state.

With the COVID-19 pandemic and a shutdown of the economy, we saw a steep two-month decline in the number of houses that went into contract. In May, however, that number increased dramatically (See graph below):This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

“This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership…This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.”

But in order to continue with this trend, we need more houses for sale on the market. Yun continues to say:

“More listings are continuously appearing as the economy reopens, helping with inventory choices…Still, more home construction is needed to counter the persistent underproduction of homes over the past decade.”

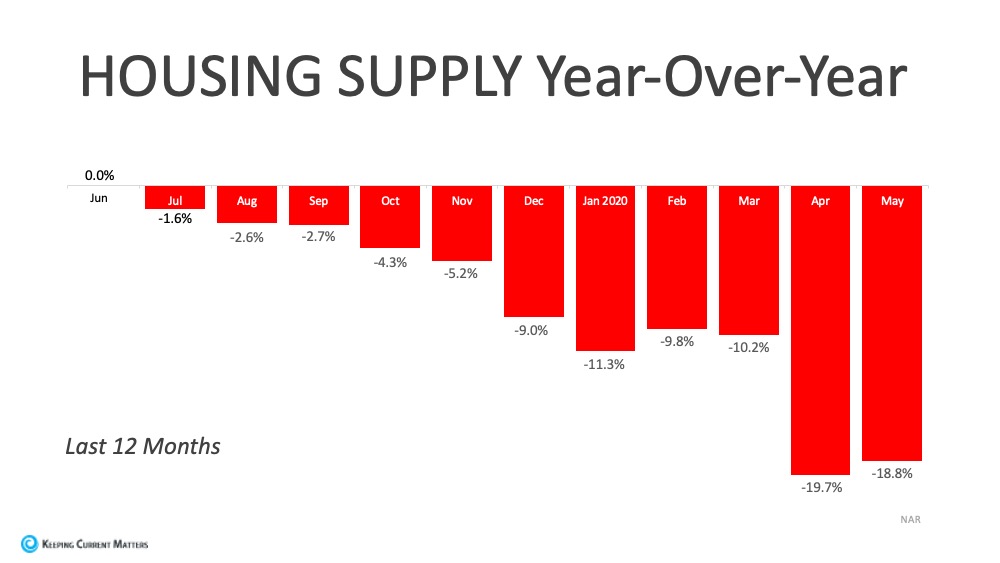

As we move through the year, we’ll see an increase in the number of houses being built. This will help combat a small portion of the inventory deficit. The lack of overall inventory, however, is still a challenge, and it is creating an opportunity for homeowners who are ready to sell. As the graph below shows, during the last 12 months, the supply of homes for sale has been decreasing year-over-year and is not keeping up with the demand from homebuyers.

If you decided not to sell this spring due to the health crisis, maybe it’s time to jump back into the market while buyers are actively looking for homes. Reach out to a local real estate professional to determine your best move forward.

There’s nothing quite like watching a movie outside in your own backyard. Whether you miss going to the movie theater or you’re feeling nostalgic for retro drive-ins, you’ll love taking family movie night outside as the weather gets warmer. And DIY backyard movie theaters are actually pretty easy to set up yourself. You can do the entire thing in about 30 minutes if you have the right equipment (though keep in mind that a permanent installation will require a bit more work). “All you need is a portable projector to turn your own backyard into an outdoor cinema—any backdrop works in the dark… a kid’s tent, hanging a sheet, the wall, or even the ceiling of an overhang, says style and parenting influencer Alicia Lund. Ahead, learn how to ready your yard for movie night in just a few simple steps and watch Lund transform her own backyard into a magical outdoor theater to see how it’s done.

Our country faces challenges all the time. Whether it’s a recession, natural disaster or, yes, even a global pandemic—no matter what’s happening in the world, life still happens. Today, many families find themselves needing to move at a less than ideal time.

Moving is always stressful, but moving while trying to navigate certain restrictions and safety regulations can quickly become an overwhelming undertaking. While many may attempt to reschedule their moves to less turbulent times, some families can’t delay the process. Maybe you sold your home before the pandemic hit and now are left to figure out the best move.

If you find yourself needing to move during these challenging times, here are some tips to make the process as smooth as possible:

Get Rid of What You Don’t Need

Decluttering and downsizing is something you should implement during any move, no matter the state of the world. Many of us have recently been spending more time at home due to stay-at-home order; use the downtime as an opportunity to go through your belongings and get rid of what you don’t use, need or want anymore. Don’t waste time and money by moving items to your new location that are just going to get tossed out soon anyway.

Go Virtual

The safety of your family should always be your top priority. Complete as many necessary tasks as you can virtually to avoid traveling when it isn’t safe to do so. Many real estate professionals have been offering virtual home tours during the pandemic, and this practice is something that is likely to continue moving forward. Communicate with your agent via video chat, phone and email as much as possible. Important paperwork and other steps involved in the closing process are often allowed to take place online during times of crisis.

Assess Your Financials

Any nationwide emergency will likely impact the economy, putting many Americans in a state of unease. Today, the country is facing massive economic upset and widespread layoffs; according to the National Bureau of Economic Research, the U.S. officially entered a recession this February. Before you fully commit to moving, make sure you understand your financial situation and what you have to work with monetarily.

Ask yourself: what’ll my income look like over the coming months? How much cash and credit capacity do I have? Do I have a plan in place to stay on top of my bills? With these answers, you can start to get a sense of how your budget will change and if you can afford a move.

Keep an Eye Out for Deals

Times of crisis can offer the best investment opportunities for those who are prepared. When the masses shy away from investing in real estate due to economic uncertainty, it might just be the best time to buy. When the housing bubble burst in 2008, most were running away from the market, but the smartest investors made tremendous deals during that time. Because real estate tends to slow in uncertain times, sellers are typically more willing to negotiate. Today’s mortgage rates are at a record low so, while it may seem stressful, now may actually end up being the best time for you to purchase a new home.

Do What You Can on Your Own

Services you might typically use like shipping and professional movers are likely to be disrupted along with most other industries. To avoid paying hefty service fees or endure long wait times, and to ensure the safety of your family and workers, you might consider tackling as much of your move on your own as you can. Consider doing your own packing and moving, and realize that if you’re shipping any of your belongings long distance they may take longer than expected to arrive. If you do need to pay for assistance, research different companies and ask questions about how their operations have changed during the pandemic.

Moving is no easy feat, especially when turbulent times put a strain on your plans. Do your research, educate yourself and make sure safety is your top priority!

Limited Inventory, Demand continues gaining momentum, Interest rates at a History Low, Plus incentives such as down-payment assistance programs for buyer are offering great opportunities to those looking to buy and sell! . . .

If you are paying more than $2,500 in rent, you can afford a mortgage. Send me a message and let’s have a conversation on how to take advantage of the opportunities now available…

by Marlon Gamez REALTOR® | Lic# 02076704 (714) 650-0567 marlongamez@firstteam.com marlongamez.firstteam.com

There were 14,148 U.S. properties with foreclosure filings in April 2020, down 70 percent from March 2020 and down 75 percent from a year ago. Nationally, one in every 9,639 U.S. properties received a foreclosure filing during the month of April.

Not surprisingly, due to recent federal legislation ordering a two-month moratorium on foreclosures by lenders holding federally backed mortgages, this is the lowest number of foreclosure filings ATTOM has ever recorded nationwide since it began tracking the data in April 2005.

“Foreclosure cases dropped dramatically last month following the foreclosure moratorium imposed on lenders holding federally backed mortgages,” said Todd Teta, chief product officer with ATTOM Data Solutions. “It’s hard to know how much this reflects the virus pandemic because the data doesn’t say whether these were cases caused by very recent job losses or were already filed before that. What can be said is that the drop-off will almost certainly be temporary. And when it’s lifted, we should be able to more clearly measure how deeply the pandemic fallout is affecting homeowners. ATTOM is monitoring this closely with monthly, quarterly and annual updates.”

Foreclosure starts drop below ten thousand nationwide

Lenders started the foreclosure process for the first time on 8,552 property owners in April 2020, down 69 percent from the previous month and down 72 percent from a year ago.

States that saw the sharp declines year-over-year in foreclosure starts, included Georgia (down 85 percent); North Carolina (down 84 percent); Florida (down 83 percent); Michigan (down 82 percent); and Colorado (down 81 percent).

In a more granular look that runs counter to the national trend, there were some counties that experienced an increase in foreclosure starts in April 2020. Those counties with an annual increase, included Marin County, California (up 76 percent); Monterey County, California (up 42 percent); Mesa County, Colorado (up 40 percent); Solano County, California (up 36 percent); and Hillsborough County, Florida (up 18 percent).

Delaware, Maryland, and Illinois post worst foreclosure rates

States with the worst foreclosure rates in April 2020 were Delaware (one in every 2,745 housing units); Maryland (one in every 3,809 housing units); Illinois (one in every 5,353 housing units); Connecticut (one in every 5,519 housing units); and Florida (one in every 6,171 housing units).

Among 220 metropolitan statistical areas with at least 200,000 people, those with the worst foreclosure rates in April were not your usual metro areas. In fact, California metro areas made up 3 of the top 5 metro areas. With Vallejo-Fairfield, California (one in every 1,105 housing units); Peoria, Illinois (one in every 1,173 housing units); Reading, Pennsylvania (one in every 1,813 housing units); Santa Rosa, California (one in every 2,016 housing units); and Salinas, California (one in every 2,434 housing units);

Among 53 metro areas with at least 1 million people, those with the highest foreclosure rates in April were Tampa, Florida (one in every 2,818 housing units); Baltimore, Maryland (one in every 3,025 housing units); New Orleans, Louisiana (one in every 3,457 housing units); San Antonio, Texas (one in every 3,519 housing units); and Louisville, Kentucky (one in every 3,746 housing units).

Bank repossessions drop 76 percent from last year

Lenders repossessed 2,641 U.S. properties in April 2020 (REO), down 71 percent from the previous month and down 76 percent from a year ago, to the lowest levels ever.

States that saw the greatest actual number of completed foreclosures but are still down from last year, included Florida (387 REOs, but down 72 percent from last year); Illinois (255 REOs, but down 65 percent from last year); California (199 REOs, but down 72 percent from last year); Georgia (194 REOs, but down 48 percent from last year); and Texas (190 REOs, but down 75 percent from last year).

Those metropolitan areas with a population greater than 1 million that saw an annual decrease included Los Angeles, California (down 80 percent); Chicago, Illinois (down 67 percent); New York, New York (down 77 percent); Tampa, Florida (down 71 percent); and Philadelphia, Pennsylvania (down 94 percent).